Startup Genome Report: Singapore vs Berlin

I got my hands on the Startup Genome report on startup ecosystems yesterday. It was emailed to me by an acquaintance who’s recently taken a strong interest in the startup scene. Having lived in Berlin for a few months, I’m going to risk some censure by pretending I know something about what goes on in the startup scene there, and compare it to Singapore, where I have lived 13 years, and understand a little better.

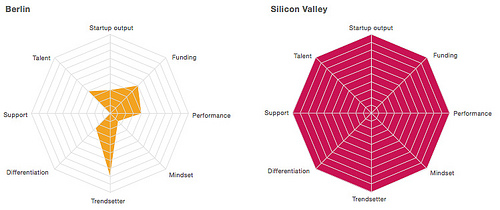

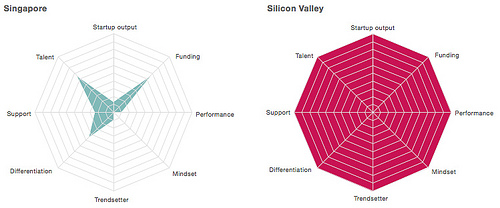

I’ll jump right into the analysis first with reference to the graphs I cut from the report above, and then to a few interesting tidbits that weren’t represented graphically but mentioned in the report body.

I’ll begin with the weaknesses. Singapore’s weakest attributes are trendsetter, mindset, and performance, while Berlin’s weakest attributes are support and mindset. Singapore’s scores don’t surprise me. Trendsetting, defined by the authors in terms of technologies used, management processes and business models adopted is a lagging indicator. Singapore is the regional headquarters of many multinational firms, and the educational landscape has grown to support their technology needs. Performance is weak, but that is understandable for a newish startup hub. Mindset is a weak factor for both cities. The authors define this as the qualities possessed by great entrepreneurs. I don’t know how that is measured but I believe that it is instinctively correct for Singapore, though I’m afraid I can’t say why this might be for Berlin. Berlin also is weak in support. I never felt even a hint of institutional support in Berlin for startups, and didn’t encounter a whole lot of startup mentors or events either. The startup community in general does not feel tightly knit. Singapore’s good support network is largely institutional, but it does a great job connecting mentors to startups and maintaining a closely knit community.

On strengths, Singapore’s strengths are funding and talent while Berlin’s are trendsetter and funding. Both cities have good funding. In Singapore, again funding is driven in no small part by government initiatives, which have spawned 8 incubators, dispensing a combination of private and public funds. For Berlin, there appears to be no institutional driver. Here is a very public shortlist of angel investors. A quick search on AngelList reveals that Berlin has 1268 investors to Singapore’s 550. The report authors note that the ecosystem is relatively high on banks and low on accelerators and VCs. It’s clearly a young scene that is gaining speed fast in Berlin.

On Singapore’s other strength - startup talent, I have a sneaking suspicion that Singapore’s strength in talent is boosted by my alma mater’s entrepreneurship program NOC. There have been over 1000 students who have gone abroad to do 1 year startup internships. The other point in favour of this opinion is that fully 33% of startup founders in Singapore have lived in Silicon Valley, which is higher even than Canadian cities, London or Paris, which top off at 25%.

Regarding Berlin’s greatest strength - trendsetting, I have to say that this is intuitively true for me. Berlin clearly is not the industrial capital of Germany, and plays host to precious few large IT companies. Google et al are based in Hamburg. There is no legacy of Java here. Startups in Berlin embrace new technology totally frictionlessly as there’s nothing from before to cling to. Lean Startups, Node.js, you name it, we have it. There are several other metrics not shown on the graphs above, and a few of them are worthy of mention. I will highlight a few and discuss their implications.

On the measure of Markets targeted (new markets vs existing niche markets), Singapore scores 1.4 : 1, Berlin scores 1.8 : 1 and SV scores 4 : 1. Overall this is an average score. The clear message is that both Singapore and Berlin startups are not gunning for truly new and disruptive innovation just yet, and is surely related to the mindset attribute from above. However, I feel strongly that only time can change this. The cities need time to find their place in the world, and discover their strengths before we see ambitious innovation. The education level of startup founders is very high in both cities. Ratio of startup founders who are school dropouts to Masters/PhD is 1:6 vs SV’s 1 : 2.5. I attribute the ratio in Singapore to the fact that local universities have departments dedicated to the commercialization of technologies developed by researchers. This is a significant boost to the ranks of founders with advanced qualifications. I don’t think that reflects a greater passion for startups within the highly educated. For Berlin, I would hazard a guess that in general, many Europeans attain a Master’s degree as a matter of course. This is borne out by the other European startup cities (with Moscow the sole exception). Surprisingly, 33% of Singapore’s founders have lived in SV while only 7% of Berlin’s founders have made the pilgrimage. Singapore’s example is truly an outlier and this surely lends weight to my guess that most of Singapore’s founders are graduates of NOC.

The final metric, which is a major one, is that Singapore startups are 2.1x (210%) more likely to tackle smaller markets than SV startups. Berlin startups by contrast are only 54% more likely, a slightly-below-average score. The ambitions of Singapore startups are markedly smaller than anyone else on this list and only Melbourne (2.0x) comes close. I don’t think that Berlin startups are generally risk-averse. I would hazard a guess that this is a reflection of realities on the ground, with scarce funding constraining ambitions for now. To close, I would like to share some personal observations. Berlin is a city with palpable energy in the air. It is benefitting from an influx of intelligent, ambitious Europeans who can’t find jobs at home and who benefit from its cheap housing and fun lifestyle. The demand for talent like online marketers is already beginning to outstrip supply. Local heroes like Soundcloud and Gidsy also give founders an example to aspire to. If tax and labour laws don’t stifle innovation, I expect Berlin to continue on its upwards trajectory.

Singapore is where I currently reside, and that may be clouding my judgment. I see that funding and support are available, though I would dispute whether a critical mass of talent is. High broadband internet penetration, high smartphone penetration, and increasing Paypal acceptance are major plus points. The biggest stumbling block is cultural. It seems pretty clear that a nascent entrepreneurial culture is developing, though how far it reaches the psyche of the city remains to be seen. I have already observed friends depart for fairer shores because the ambitions and capabilities of local companies could not match those abroad. The extent of this cultural transformation will be the greatest determinant of success or failure.

Tweetcomments powered by Disqus